With balance sheets reeling from lost NSF- and interchange income, retail financial institutions are grappling with two big questions:

1. “Should we eliminate free checking?”

2. “Should we introduce new fees or account requirements?”

Before you answer those questions, you should check out this report, “Free Checking & The Banking Customer.” It’s a nationwide U.S. research study from ACTON Market Intelligence asking consumers for their opinions on free checking accounts, new potential fees and other account requirements. The report examines the strategic significance of free checking and analyzes consumers’ projected acceptance to various alternative banking fee strategies. The report is based on a consumer survey encompassing 10,000 households, conducted in October 2010.

Before you answer those questions, you should check out this report, “Free Checking & The Banking Customer.” It’s a nationwide U.S. research study from ACTON Market Intelligence asking consumers for their opinions on free checking accounts, new potential fees and other account requirements. The report examines the strategic significance of free checking and analyzes consumers’ projected acceptance to various alternative banking fee strategies. The report is based on a consumer survey encompassing 10,000 households, conducted in October 2010.

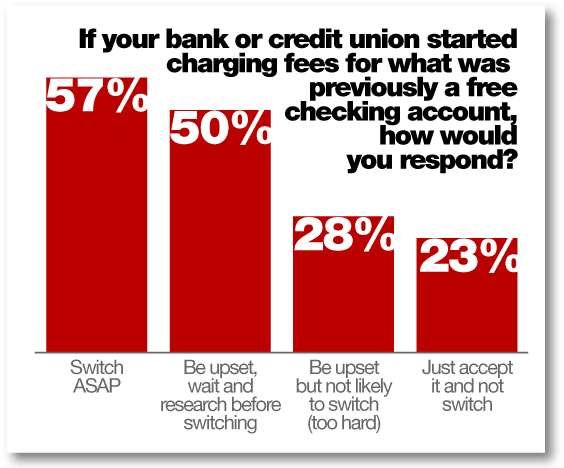

The report also explores switching triggers, asking what it takes to motivate consumers to move a checking account to another financial institution. One question asked how people would respond if their free checking account had fees added to it. A significant two-thirds majority (67%) said they would likely switch to another financial institution.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

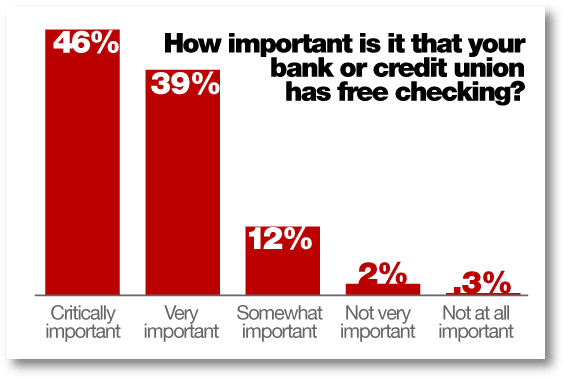

How important is free checking?

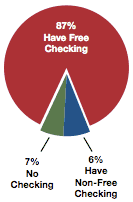

87% of American adults age 18+ have a free checking account. Nearly all of them (85%) feel that free checking is critically or very important in their selection of a primary bank or credit union. Less than 3% of the checking customers in America said free checking isn’t important to them.

Men and women feel differently about free checking. 92% of women felt that it was critically- or very important that a financial institution offer free checking, whereas only 79% of men feel the same way. 94% of women age 18-24 have a free checking account compared to 80% for men. In the 25-34 age group, 91% of men have free checking compared to 78% of women.

Those in the west are more likely to switch. 66% of those in the western U.S. said they would switch immediately if their bank or credit union introduced new fees on a previously-free checking account. Only 50% of those in the Northeast said they would switch.

How will consumers react to new fees?

Over half (57%) of the checking account customers in America are highly at risk to switch banks if their institution began to charge fees for what were previously free services for their checking accounts. Slightly less than one in four (23%) customers would passively accept the implementation of such fees by their bank or credit union.

“This report shows most consumers are not in the mood to pay more banking fees,” says Brian Beach, ACTON Marketing CEO. “Those financial institutions that keep free checking will have a market advantage over their competitors.”

“The real opportunity here for smaller banks and credit unions is to not only retain their current free checking accounts but to aggressively promote them in an effort to increase checking account market share via switching,” the report advises.

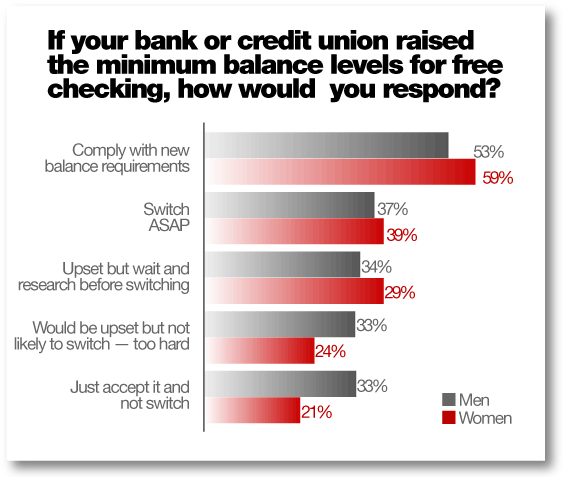

What about adjusting minimum balance requirements?

Regardless of gender, a majority of checking customers say they would increase their balances in order to keep free checking.